Alarming Payment Schedule for Physicians, ASC, and HOPD Rules

July 26, 2022

Once again, physician payment, as well as ASC and HOPD rules, are out. The most alarming is physician payment, followed by ASC and HOPD rules. The rules show reductions of 4.4% in the conversion factor even though the makeup was only 3% during last year. In addition to this, we must add, as we have been repeatedly saying, a total of 6% leading to 10.4%. With 9% inflation, we are looking for physician payment cuts of 20%.

Enclosed, please see sample rates compared to 2022. In addition to the 4.4% cuts, some codes have faced higher reductions with very few codes facing increases. The same applies with 10.4% cuts.

In reference to ASCs, as of now, they are not proposing any cuts; however, a 6% cut will remain in effect unless it the 2% sequester cut from ACA and 4% statutory PAYGO from the American Rescue Plan Act is eliminated.

The fee schedule remains stable except for a few small increases. Some of the procedures that received major increases include sacroiliac joint arthrodesis and moderate increases for peripheral nerve stimulators.

We are providing links to abbreviated sample fee schedules for physician payment and ASC.

Please visit ASIPP Members Only website to obtain Physician, ASC, and HOPD payment schedules.

Onerous 10.4% Cut is Coming for Physicians, Compounded by an Escalating 9% Inflation, Equaling a 20% Cut: Act Now! Your Survival is at Stake

UPDATED on July 20, 2022

CMS has published the 2023 Physician Fee Schedule and it is worse than we expected. The conversion factor has been reduced by 4.4%. It will be reduced from $34.61 to $33.08, a decrease of $1.53. This will be added to the 2% sequester cut from ACA and 4% statutory PAYGO from the American Rescue Plan Act. This is equal to nearly a 20% cut when you combine this with inflation.

Unless Congress acts, the total expected cuts are 10.4% from 2022, and 9.75% from 2021, starting January 2023.

We encourage every ASIPP member to join us in the effort to contact every member of Congress. You can start by contacting the Senators and Representatives of your district. It is essential that we act soon and participate in meetings with members of our Congress, as well as start a letter campaign involving physicians, providers, nurses, staff, and most importantly, the patients.

Please see the fact sheet (FACT SHEET) and sample letters (SAMPLE PHYSICIAN LETTER) (SAMPLE PATIENT LETTER).

COVID-19 Pandemic, Current Medicare Payment System, Impending Cuts of 10.3%, and Fraud and Abuse Investigations: A Perfect Storm is Brewing

UPDATED on July 7, 2022

In January 2023, physician practices face the following Medicare financial hits:

● Potential 10.3% cuts in physician payments, 6% cut in facility payments, extensive fraud and abuse investigations with refund requests and increasing work related to documentation for Merit-Based Incentive Payment System (MIPS).

To avert these disasters, we want to start this campaign as early as possible as the fee schedule publication season is coming. Initially, we would like for you to prepare your own letters explaining the issues at a personal level and write to all your members of the Congress and Senate, which is only 3 letters. Everyone in interventional practice should do that. Following this, we can get patients involved. We will open a website to sign on to this in an easy manner. It is crucial that you personally reach out to everyone in the next 2 weeks or so before we proceed with a massive campaign.

On behalf of the membership, ASIPP is proposing the following to reverse these trends:

1. Adding a 3.75% increase and making it permanent instead of the 3% from last year in the Medicare physician fee schedule (PFS) conversion factor to avoid payment cuts associated with budget neutrality adjustment tied to PFS policy changes.

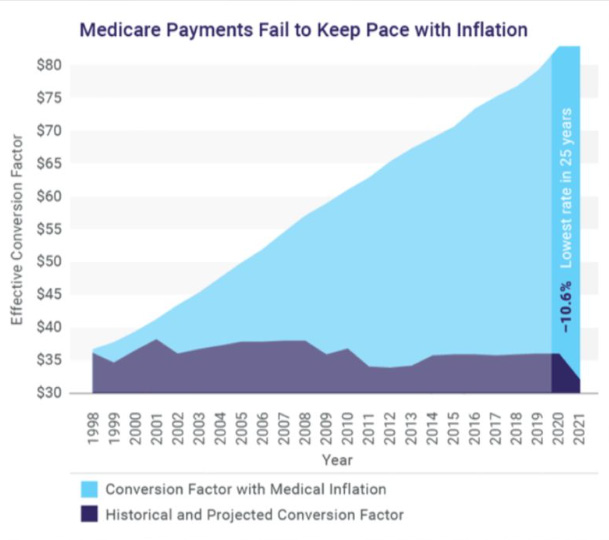

· Historically, the conversion factor when t started in 1992 was $32, with inflation it must be $59; however, with a 4.5% cut from 34.6062 to 33.0775 if the proposed rule is adopted. Please see the graphic presentation in the enclosed Fact Sheet.

2. Elimination of the 2% sequester completely without budget gimmicks and extending potentially through 2050. This policy was scheduled to sunset in 2021. Consequently, it is high time for the policy to be removed without gimmicks.

3. Wave the 4% statutory PAYGO sequester permanently. This sequester was a result of the passage of the American Rescue Plan Act. Further, Congress should enact legislation so that Medicare will never be included so that elderly and providers will never be punished for government spending activities.

4. Remove facility cuts by eliminating the 4% statutory PAYGO sequester resulting from passage of the Budget Control Act of 2011 and under the American Rescue Plan Act of 2021 and eliminating the 2% cut from sequester, which was set to sunset in 2021.

5. Provide financial stability.

It is crucial that Congress provide financial stability to providers with or without systematic reform to Medicare so that the system works better for patients and providers through a baseline positive annual update reflecting inflation and practice costs. Furthermore, Congress should eliminate, replace, or revise budget-neutrality requirements to allow for appropriate changes in spending growth.

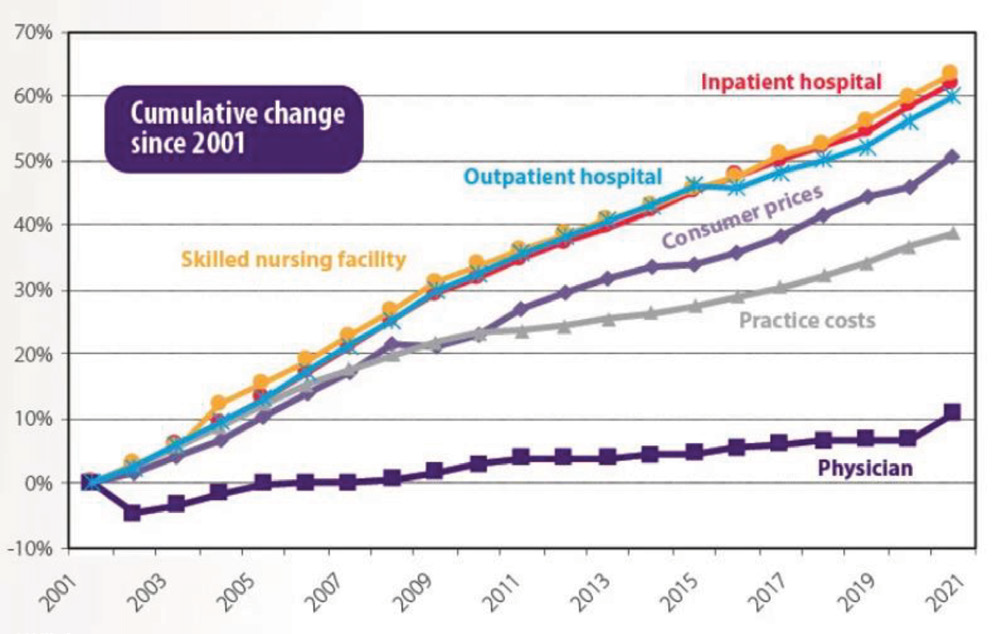

It is hard for any person to understand why providers are the only ones being affected when all other sectors of Medicare continue to increase several-fold compared to physician payments.

6. Reform fraud and abuse investigations policies.

At present, the Office of Inspector General (OIG) and multiple private contractors have their own policies of investigation with any regard for established local coverage determinations (LCDs) and medical policies.

· These audits and investigations, specifically from private contractors, are also defying precertification rules and regulations and demanding refunds on each and every patient even though a precertification has been obtained.

· The demands of these investigations are costing physicians hundreds of thousands of dollars financially and creating unnecessary mental stress. These also increase future costs by increasing provider time and require the investment of substantial resources just to meet everchanging computerized program criteria developed by the same people who developed electronic medical records (EMRs) and established these EMRs for so-called rapid documentation, which is now considered to be copying/pasting, cloning, cloned verbatim, pre-populated, highly redundant, and auto filled, beyond obligations from MIPS, LCDs and medical policies.

It is essential that we act soon and participate in meetings with members of our Congress, as well as starting a letter campaign involving physicians, providers, nurses, staff and most importantly, the patients.